The bull market trend behind Bitcoin, in particular, continues as the crypto market’s Fear & Greed Index has finally turned green.

Bitcoin (BTC) bulls have reason to celebrate as the fundamental indicator bounces off the longest bear market in its history.

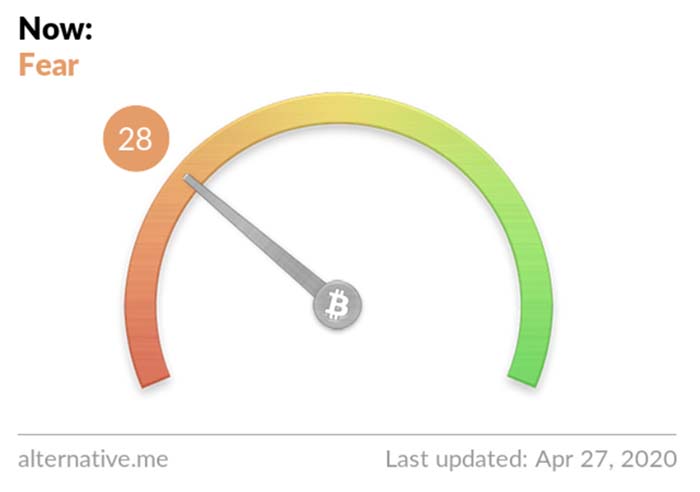

According to data last updated on April 27, the Crypto Market Fear & Greed Index has broken out of its all-time low – the “extreme fear” zone – after 7 weeks.

Who is afraid of big bears?

As noted on this indicator starting in 2018, the event reflects the impact the coronavirus pandemic has had on the crypto market.

The F&G Index is a number between 1 and 100 that analysts select from a basket of factors including volatility, market volume, and social media activity.

The closer the index is to 100, the more cautious investors should be, as the market is overzealous and often gets carried away.

“With the F&G index, we try to help you avoid your emotional overreactions,” the tool’s founders sum up on their official website.

At the time of Monday’s report, the index was at 28, which is in the “fear” threshold, up from 21 the day before. Correspondingly, the relevant index for traditional markets and equities is at 40, also at the “fear” threshold.

See more: Bitfinex’s New Social Network Increases Traders’ Chances of Success

Bitcoin’s Intrinsic Loss Control Tools

F&G is just one part of the positive signs that are welcoming Bitcoin investors this week.

According to a report from Cointelegraph, strong technical fundamentals have also returned, supporting a 10% price rally that surprised many over the weekend.

As such, Bitcoin has succeeded in overcoming the negative consequences of the Corona virus pandemic without any outside intervention such as fiat money.

Attention is now focused on the Bitcoin Halving, the most eagerly anticipated event in Bitcoin’s history. Follow primexbt to update the latest information.

Leave a comment