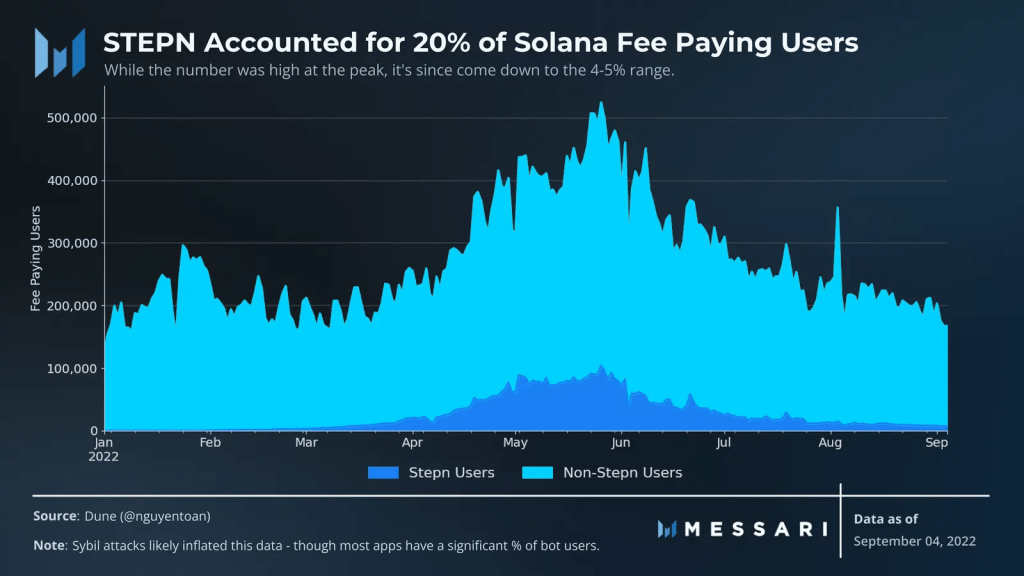

At its peak in May, STEPN accounted for almost 20% of the unique daily paying users on Solana. It is one of the projects that has the user base of one of the most productive blockchains in history on a “Move to Earn” app. STEPN’s success is hailed as a strong point in the use case of the “Play to Earn” model.

However, that peak has passed and the aura has also disappeared. Over the past three months, the key indices have been on a continuous downward trend. What was once an obvious case for bull markets now seems to be a case study for bear markets.

The whole story is still ongoing and doesn’t seem to be over yet. The STEPN team has been actively changing their game to improve token economics and user experience.

The question is: Will those changes be enough to bring STEPN back to the pinnacle of glory? Or is the economic model behind the game too fundamentally flawed to be sustainable?

Boom cycle to make money

Move to earn tokens. It was the basic model that took STEPN’s economy to new heights. The model is backed by a pooling system of token liquidity and cash flow, which in theory should promote the relative stability of the in-game ecosystem.

The system uses a two-token approach similar to that popularized by Axie Infinity, with GMT as the governance token and GST as the utility token of infinite supply.

Both can be earned and spent in the game. Completing the system are NFT-style sneakers purchased or minted by the player to participate in the game. Simply no shoes, no service.

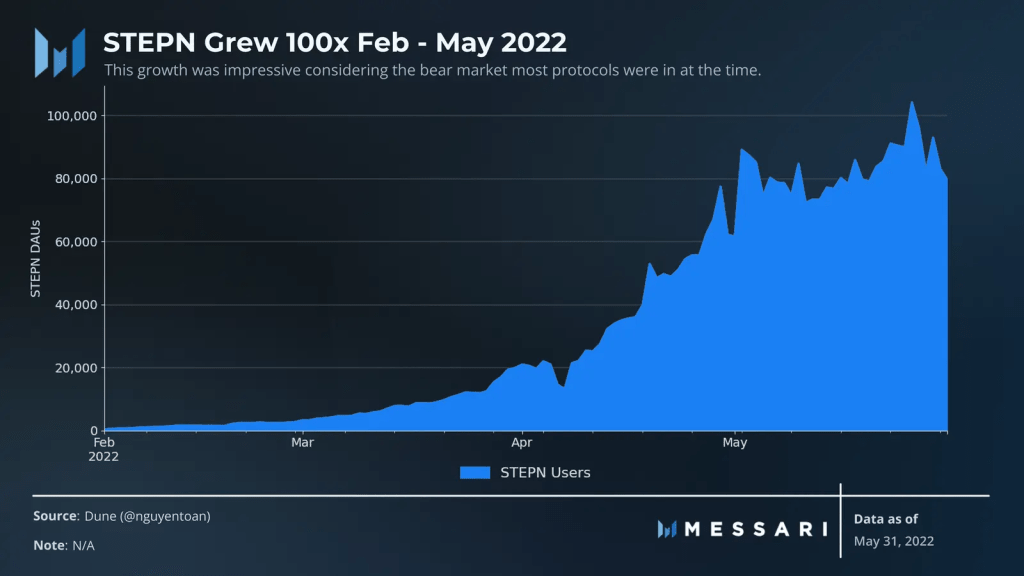

When the time is right, the system works extremely well.

- Q2 profits from the market and minting fees were sky-high at $122.5 million.

- Daily active users (DAU) increased by 100x.

- STEPN’s market share in Solana-based decentralized exchange trading has grown exponentially – first through Orca and then through STEPN’s native DOOAR DEX.

→ It was really the best time.

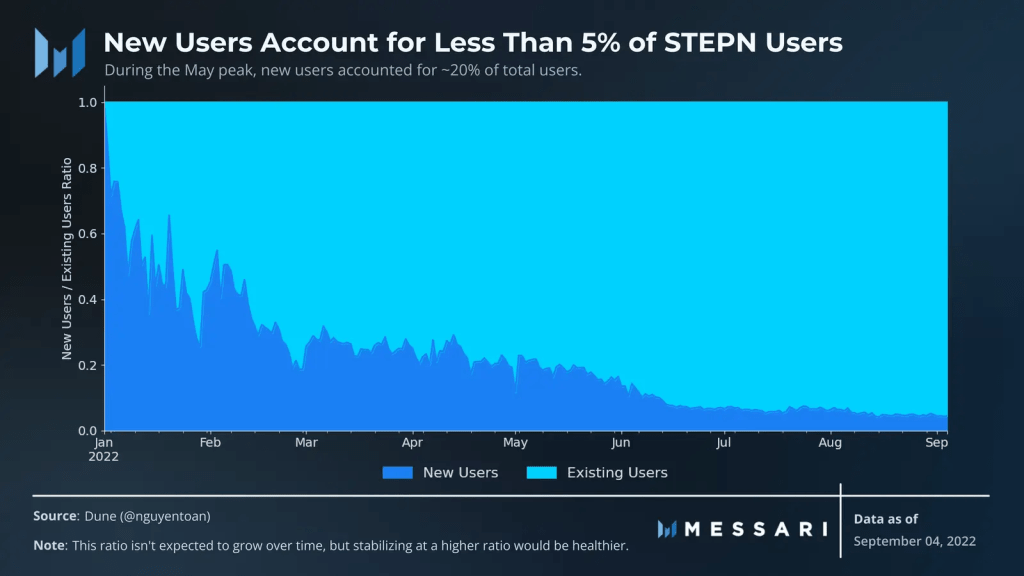

That explosive growth was followed by a similarly explosive drop. Daily active users have decreased by 80%. As the third quarter ends, revenue is expected to decline similarly. The most worrying thing is that new users have dropped from 20% to 5% of STEPN’s total users.

The majority of STEPN’s revenue comes from athletic shoe mint fees and secondary sales. Without many new users, the new minted shoes will drop significantly. The limited number of new users reduces the revenue of the protocol and leaves existing players absent. This means that there are no new market participants to trade on the secondary market.

Try to reverse the downtrend

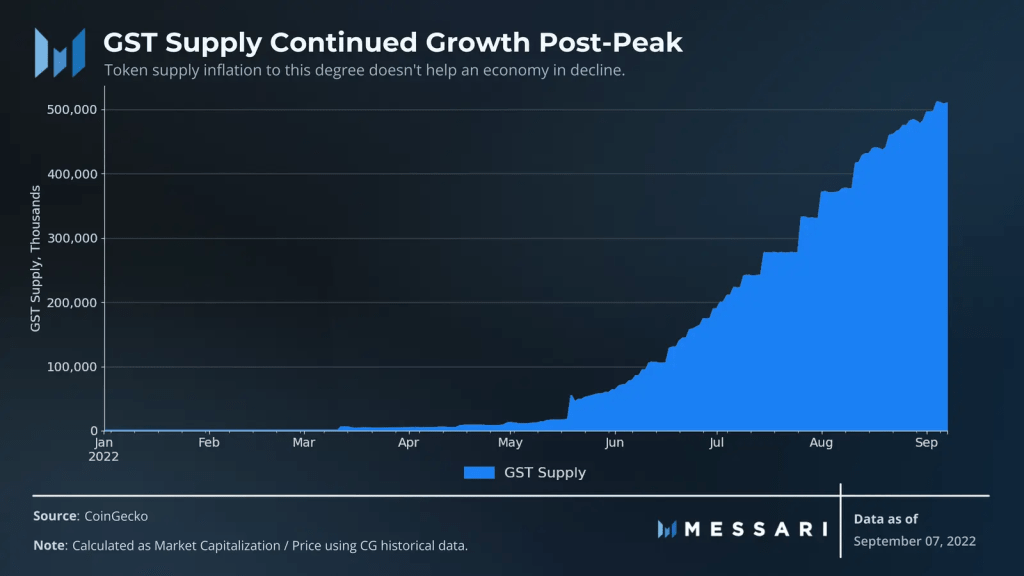

Falling demand is only one side of the problem. On the other side of the equation is an exponentially increasing supply. There is no supply cap for GST, the utility token has experienced hyperinflation of the supply in the past few months.

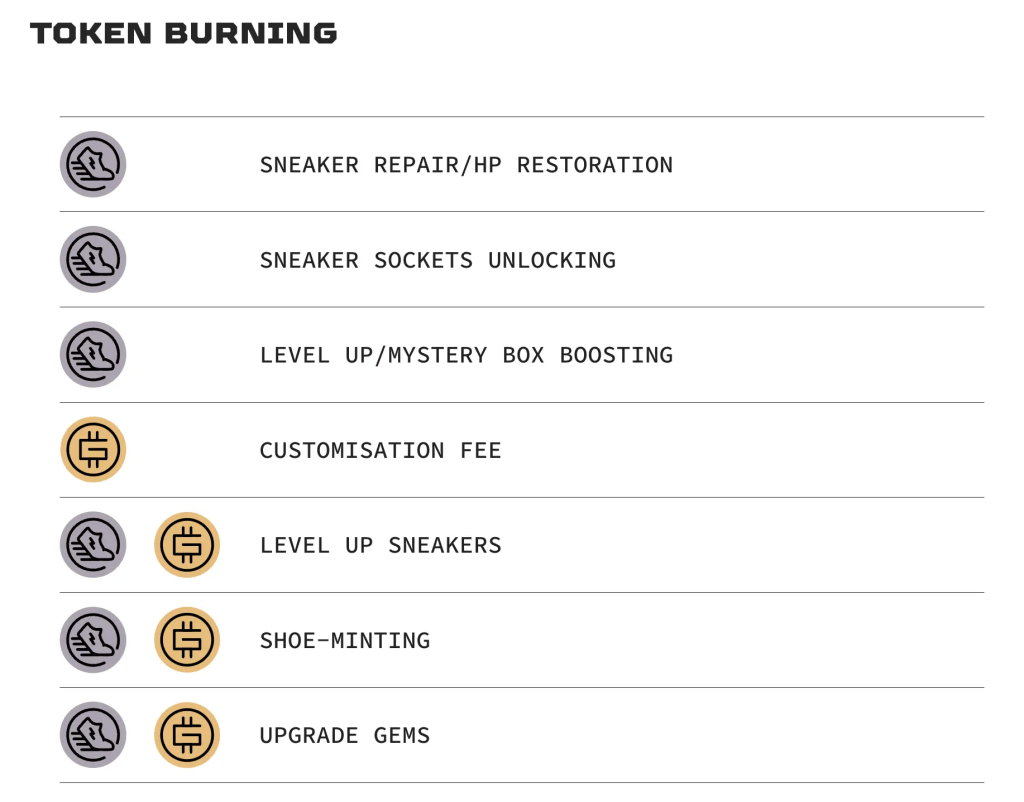

The STEPN team has implemented a list of actions to try to mitigate and reverse the downturn in major indices, with the additional hope of addressing token supply issues.

A common theme throughout their actions is the introduction of more ecosystem tokens like BNB, ETH into the economy. The team plans to counterbalance selling pressure from financially motivated players by adding deflationary pressure on tokens.

However, this is not possible at present. For liquidity pools to work, users must be willing to use them. Users are free to sell their abundant tokens to USDC instead of using a liquidity pool. As a result, they won’t have the intended effect unless the sunken supply provides enough incentives.

For example, imagine a drop in supply focused on repair prices for in-game sneakers. If a user hasn’t been able to land on a GST sale to USDC, they won’t care if you have to pay 1 or 2 GST to fix your sneakers. They will continue to sell GST to USDC.

Man-made supply shocks cannot solve the problem of demand. To be fair, STEPN has driven significant protocol demand in the past. This time around will be a much bigger challenge. The price of GST, a utility token, is down 99.6% since its all-time high. Incentivizing users to hold or reinvest this utility token is nearly impossible when users do not expect (or have experienced) a drop in the past.

In addition to new token drops, STEPN has managed to increase demand through expansion into new ecosystems and reduce excess selling pressure by reducing fraud. STEPN’s expansion to Ethereum and BSC has received little adoption compared to the massive success on Solana. Reducing the presence of fraudsters will help reduce unwanted selling pressure, but the effectiveness of the STEPN Anti-Fraud Model (SMAC) is still unknown.

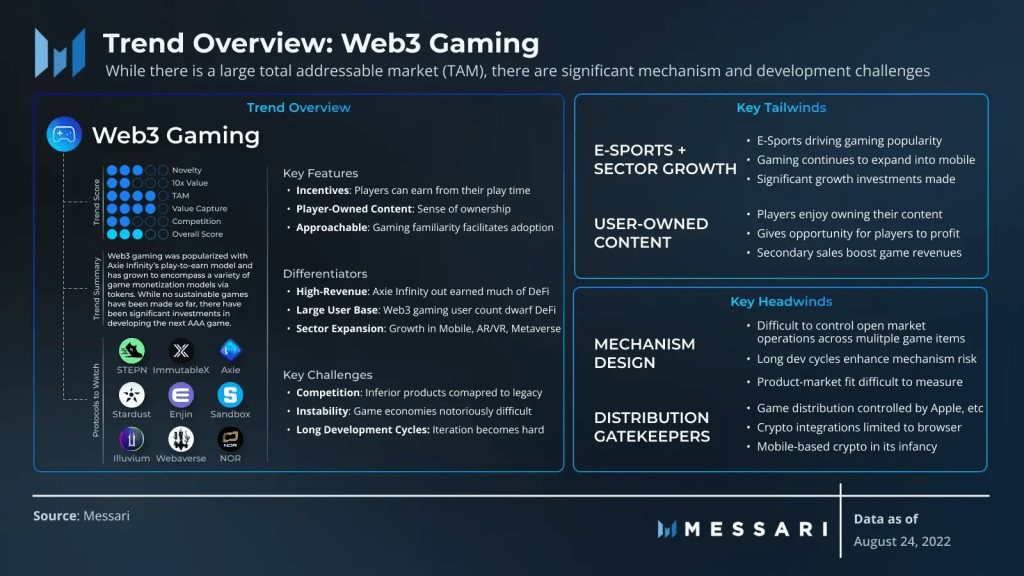

Consequences for Web3 Gaming

Web3 games have attracted large investments in the past year. Axie Infinity and later STEPN inspired investors to pour billions of dollars into the blockchain game concept. The STEPN bust boom cycle outlined above demonstrates that there are still many major unresolved issues.

STEPN is a perfect microcosm of the key features, differences and challenges that Web3 games will face in the future. Incentives Monetization, ownership, and a STEPN support a relatively easy user experience on top. In doing so, the protocol generated $126 million in revenue thanks to the support of 100,000 daily users.

The instability caused by the net outflow of players and inherently brought it all down. Additional sinking tokens and modified incentive plans have yet to improve the system. There is no rush to earn thousands of people by playing the game, the user has already moved on to the next game. This is not an attractive state for gaming investors, who typically lock in a longer-term investment after a 6-month boom cycle.

To address fluctuations in the in-game economy, developers can start by supporting one or both in-game currencies with a treasury of more stable currencies. Countries have reserve currencies – why can’t digital countries do the same?

Protocols like STEPN that use treasury reserves will effectively set a floor for the price of in-game currency. If STEPN anchors their coffers so that 1 GST always equals 0.1 USDC, the price of GST will have a hard time falling below 0.1 GST/USDC. As the use of the protocol expands, a portion of the market fees could go towards growing the backing of the treasury. If the treasury can grow at or above the rate of token issuance, the exchange rate will hold.

Backing up in-game currency with stable currencies is just one potential design choice. If Web3 games are to gain their place as a potential catalyst for another bull market, games will need to experiment with reserve currencies, stronger token discounts, lower inflation, and more. broadcast and more.

summary

STEPN’s pinnacle shows why GameFi is so appealing to developers and investors alike. Despite its problems, the protocol has brought in a massive influx of new users and a massive wave of earnings on the blockchain – a feat most crypto apps can’t achieve during the bull market. , not to mention in a bear market for almost every other asset.

In the end, however, the instability of STEPN’s two-token model soon caught on. People whose money printer is NFT STEPN sneakers tend to print money. When people with printers began to outnumber those who wanted to print money, the whole system fell apart.

However, it remains unclear whether STEPN’s team will be able to reverse the current sizable downtrend of the protocol. If they can’t, STEPN and the Web3 gaming industry as a whole will likely have to pivot away from the two-token model to other, more sustainable models.

Personally, I also joined STEPN from the early days, and really Step N was very attractive to users in the peak days and very attractive to invest. Initially, I also expected the project’s handshakes with real-life shoe businesses in encouraging marketing support for each other. But in the end, the project revenue does not come from any other source but only from new players. Thus leading to a rapid demise and making people skeptical of the ponzi token project. At the same time, most of the spin-off projects were also affected and affected before they even started to launch. However, the crypto market is like that, people mostly join to make a profit before joining for other purposes. Most investors want to stay short-term and reap the benefits.

As analyzed above, the next GameFi will need to have more sustainable models to attract players and cash flow.

If you are interested in other information about the market and projects, please register and join Primexbt blog and channels below to discuss with admins and many other members in the community, see some post about primexbt:

https://primexbttrading.amebaownd.com/

https://primexbttrading.amebaownd.com/posts/37436950

Leave a comment